Seven out of 10 people over the age of 651 will need extended care at some point in their lives, and the costs of home or facility care can add up fast.

Wellabe Short-term Care insurance can help your clients keep their assets and retirement savings well protected if something unexpected happens.

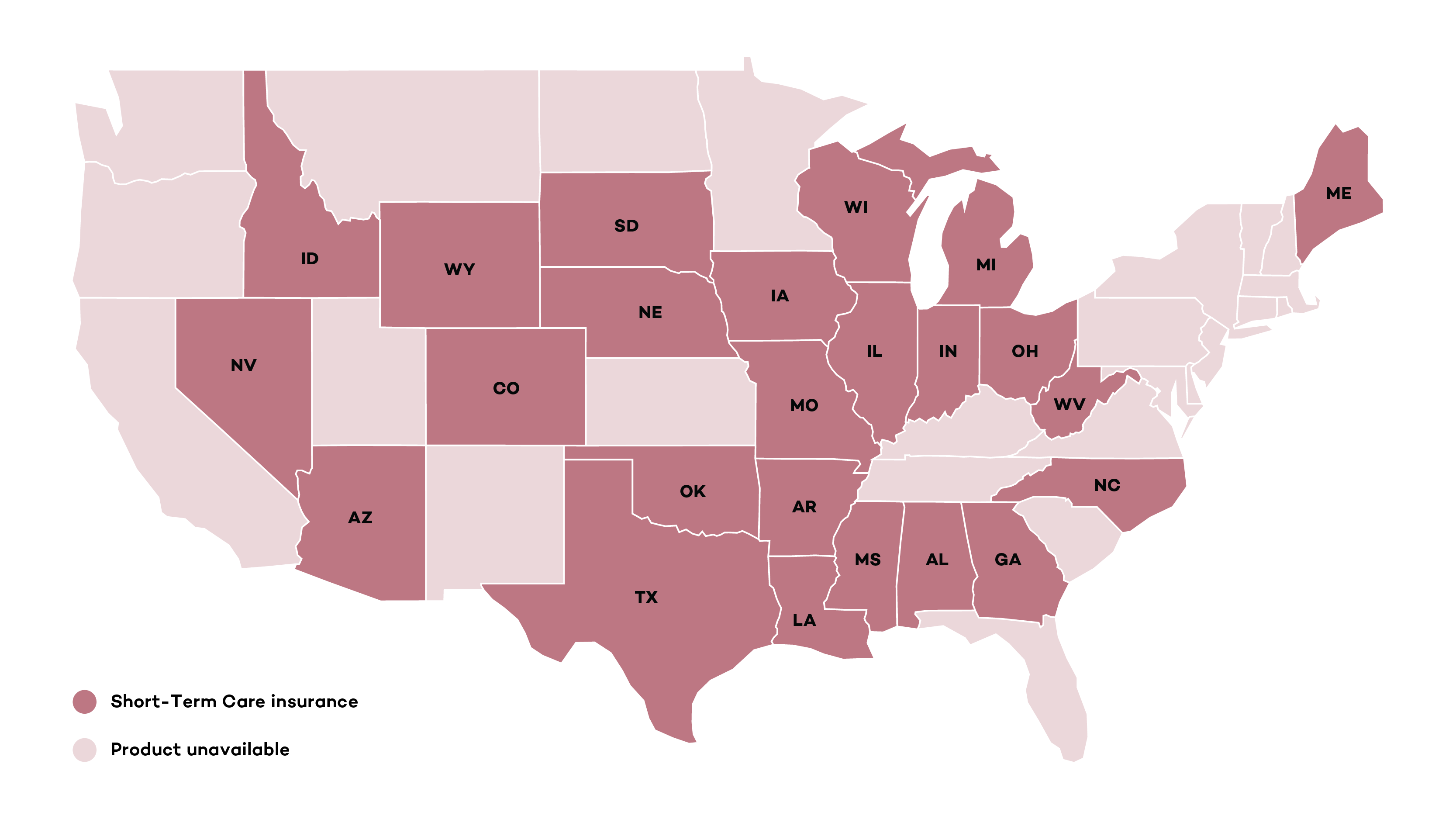

Now available in 24 states, Wellabe’s Short-term Care insurance complements your portfolio because it:

Learn more about Short-term Care insurance and see how it can benefit you and your clients.

Earn $400 on your first qualifying application after March 1, 2024, followed by $150 for any additional qualifying applications.2

Access Short-term Care insurance resources on Wellabe’s agent portal.

Sources

1. Administration for Community Living, https://acl.gov/ltc/basic-needs/how-much-care-will-you-need

2. For qualifying Short-term Care insurance applications between March 1, 2024, and June 30, 2024. A minimum of three qualifying applications must be submitted and approved to qualify for the per policy payout. Payments are retroactive to the first application.

For agent use only. Not for consumer solicitation.